Although Target is one of the biggest retailers in the country, the company has regularly faced criticism for numerous reasons. Several years ago, Target failed to protect its customers’ data allowing this information to be stolen by cyber hackers. In 2013, the company experienced one of the biggest data breaches with at least 40 million credit and debit card details being stolen. It would eventually close the settlement by paying $18.5 million to 47 states.

According to some, Target has a history of racial discrimination against employees despite being considered one of the more liberal corporations in America. Regardless, many Americans prefer shopping at Target because the atmosphere tends to be more relaxing than what Walmart has to offer. Individuals attempting to shop on Target.com should do so with extreme caution.

Target’s anti-consumer policies mean the customer’s money could be held in limbo for 30 days or longer.

Target Pre-Authorization Charges

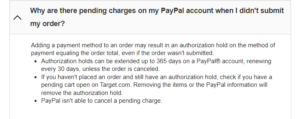

Target shoppers should avoid using PayPal as their preferred payment method. Even if the order is not finalized and completed, a pending charge will be added to your PayPal account making it impossible for you to use your money on Target’s website or elsewhere. Target’s website states, “Adding a payment method to an order may result in an authorization hold on the method of payment equalizing the order total, even if the order wasn’t submitted.”

The website makes it clear that authorization holds can be extended up to 365 days on a PayPal account with the hold renewing every 30 days unless the order is canceled. Unfortunately, PayPal isn’t able to cancel a pending charge. As a result, consumers are left with no options considering Target’s customer support is less than helpful.

What This Means

When shopping at Target.com, the customer will add items to their cart. Then, they’ll access their cart to complete the order. When doing so, the customer must specify their payment method. At this point, you can switch from a credit or debit card to a PayPal account. When doing so, you will be asked to log into your PayPal account.

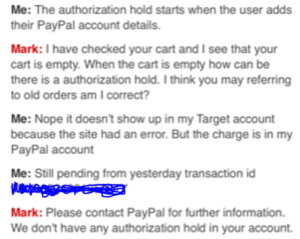

All of this happens before you’ve completed your order. However, an authorization hold is immediately placed on the account once you’ve logged into your PayPal account and before you’ve ordered the items in question. In essence, Target will remove the money from your PayPal account even if you haven’t completed the order. If you leave to shop for more items or decide to wait, there is a good chance that the authorization hold will remain on your PayPal account for the time being.

Why It Matters

Unfortunately, this creates a big problem for individuals wanting to use their PayPal accounts to shop at Target.com. Once you’ve switched to your PayPal account, your account will be charged and the money will be removed from your account. The money is effectively frozen so it cannot be returned, refunded, or used. PayPal is unable to cancel a pending charge.

Suffice to say, Target has the customer over the barrel forcing them to wait until they decide to refund the money. Alternatively, the customer can try to finish the order although they may be double charged. Unfortunately, the pending charge may remain indefinitely.

What Does PayPal Say?

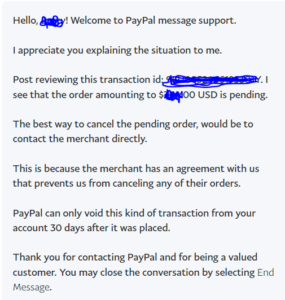

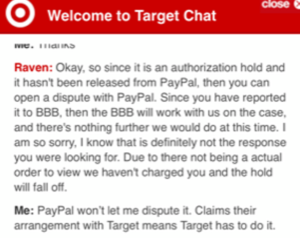

PayPal isn’t eager to help resolve this problem. The company’s customer service representative specifically states, “the best way to cancel the pending order, would be to contact the merchant directly”. The merchant has an agreement with PayPal that prevents PayPal from canceling any of their orders.

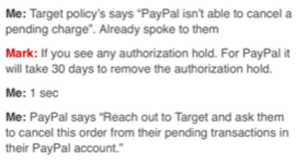

PayPal will only void this type of transaction 30 days after it was placed. Despite repeated messages to PayPal, the company offers no solution besides asking the customer to “reach out to Target and ask them to cancel this order from their pending transactions in their PayPal account”.

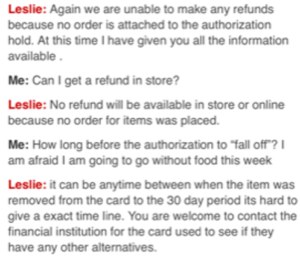

Sadly, this means that the customer will have to wait more than 30 days for the payment to be removed. Until 30 days have elapsed, the payment will be held. Even 24 hours are too long in this type of situation. During a global pandemic and economic downturn, American consumers cannot wait 24 hours or 30 days to get their money back because it could be their rent money, money for vital medications, or grocery money. Plus, the customer has done nothing wrong.

What Does Target Say?

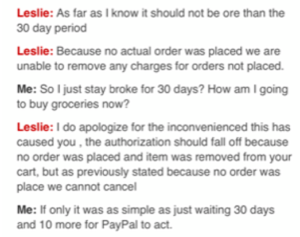

Target isn’t much better in this regard. First, there may not be an order linked to the transaction. If the order fails after the authorization hold has been enabled but before the order is placed, there will be no order logged in the user’s account. Target’s reps will not have access to this information and it will not show up in the customer’s prior orders.

One customer service representative claimed the charge would be reversed in 5 hours, but that has not happened. When speaking to a Target “supervisor” the customer is told that “Since it is an authorization hold and it hasn’t been released from PayPal, then you can open a dispute with PayPal”.

They also state, “Due to there not being a actual order to view we haven’t charged you and the hold will fall off.”

Can customers really believe this? The 5-hour threshold has already passed, but the hold has not “fallen off” yet. Furthermore, Target’s website states, “Authorization holds can be extended up to 365 days on a PayPal account, renewing every 30 days, unless the order is canceled.”

What To Do?

What should customers do when experiencing this problem? According to Target’s website, “If you haven’t placed an order and still have an authorization hold, check if you have a pending cart open on Target.com. Removing the items or the PayPal information will remove the authorization hold”.

Unfortunately, the customer in question tried both. Now, the customer’s account has been disabled by one of Target’s customer service representatives. Suffice to say, there is no way for the customer to get their money back. Instead, Target expects the customer to wait patiently until the money is magically returned to their account.

Alternatively, the only possible solution is to file a BBB complaint against Target since it has no intention of helping. Those who used credit or debit cards and experienced this issue may be able to resolve the problem using a chargeback. However, it is generally safer to avoid using Target’s website because errors like this are common and there is no clear path to resolve the problem.

The biggest issue is that there will be a lengthy wait before the customer gets their money back. The product or products they were trying to buy will not be shipped.

Is Shopping On Target.com Worth It?

Target has a wide selection of items. The customer service is quick to respond, but unable to help even with the most basic problems. A quick response doesn’t cut it when the customer service is inefficient and unhelpful. Sadly, it is hard to justify shopping at Target.com considering the risks are immense.

The authorization hold placed on someone’s PayPal account well before the order is finalized isn’t right. There is no clearly defined time period for the authorization hold to be lifted. After 30 days, PayPal may step in but it’ll likely take even longer for the hold to be lifted. Can you really go without your money for 30 days without knowing whether you’ll get it back or not?

Until Target changes this policy, it is a good idea to stay away from the company’s website. It simply isn’t worth it. After all, your money is held before you even complete the order. That hold may not be lifted for more than 30 days. In this day and age when people rarely have a few hundred dollars in their bank accounts, that is downright frightening.

Jay Skelton is an independent crime journalist with a passion for covering the uncovered and the under covered.

0 Comments Leave a comment