Zelle is an app that offers virtual money transfer from consumer to consumer and consumer to business via banks and other financial institutions. The Zelle app only serves American accountholders.

How does Zelle App Work?

Zelle works by linking directly to its members’ bank accounts, like PayPal, the CashApp, and Google Wallet. Money is transferred virtually from one bank account to another within minutes. Only registered members are authorized to utilize Zelle.

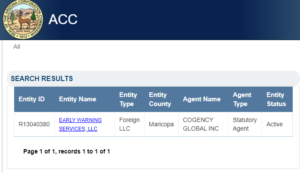

Zelle – A Foreign LLC

Early Warning Services, LLC, a financial technology (fintech) company, is the owner and operator of the Zelle app. The company is located at 815 North 1st Avenue, Suite 4, Phoenix, AZ 85003. The Arizona Corporation Commissions website shows the company as a foreign LLC.

Zelle Partners

Zelle claims to have 924 financial institution partners, which include most of the major banks – Bank of America, BB&T, Capital One, Citi, SunTrust, USAA, Wells Fargo, Morgan Stanley, KeyBank, First National, and First Tennessee.

BBB Rating

Early Warning has an A+ BBB rating if that says anything since the organization is notable for protecting its Accredited Partners.

Zelle Scam

Online scams are generally linked to people in foreign countries. There are 10 foreign countries notorious for online scams. These include Romania, Philippines, South Africa, Venezuela, Indonesia, Pakistan, Brazil, China, India, and Nigeria. If you become a victim of a scam, you can pretty much bet the responsible party is living in one of the above countries.

Zelle, like other digital payment networks, is notorious for scams. While the app or payment processor is legit, there is a scam artist lurking around every corner preying on unaware American consumers.

One particular victim, Deborah Steidl, a Vernon Hills resident, took her story public in October 2018. Steidl alleged she was scammed for $2,540 via Zelle. Steidl told CBS 2 she was unfamiliar with the app, which is built into many banking apps, including Fifth Third.

It was later discovered Steidl’s husband utilized a library public computer to access their bank account several months prior to the scam. Fifth Third denied Steidl’s fraud claim after it was determined the three money withdrawals were legit.

Zelle scam victim, Vancouver resident Troy Hopkins told NBC he was taken for $6,400. Like Steidl, Hopkins claimed to have no knowledge of the Zelle app. He was shocked when he discovered scam artists had drained his bank account in 2019.

Afterword

The FTC warns American consumers to never share bank account information over the phone. It is also not wise to access your bank account via a public computer or Wi-Fi. Scam artists are utilizing techniques like keystroke logging to capture particular data like bank account passwords.

While Zelle may be legit, it is crucial to take precautions when sending and receiving money via the app. Unfortunately, Zelle, Venmo, and CashApp do not offer fraud protection to its members. In 2019, Zelle transferred $187 billion, which was a 57% increase from 2018.

Zelle charges its members between $0.50 and $0.75 per transaction. But, no fraud protection for its members. PayPal may be the better option since it offers buyers and seller fraud protection. PayPal charges American consumers $0.30 plus 2.9% on each transaction. While these fees are slightly higher than Zelle fees, it includes fraud protection.

Jay Skelton is an independent crime journalist with a passion for covering the uncovered and the under covered.

0 Comments Leave a comment